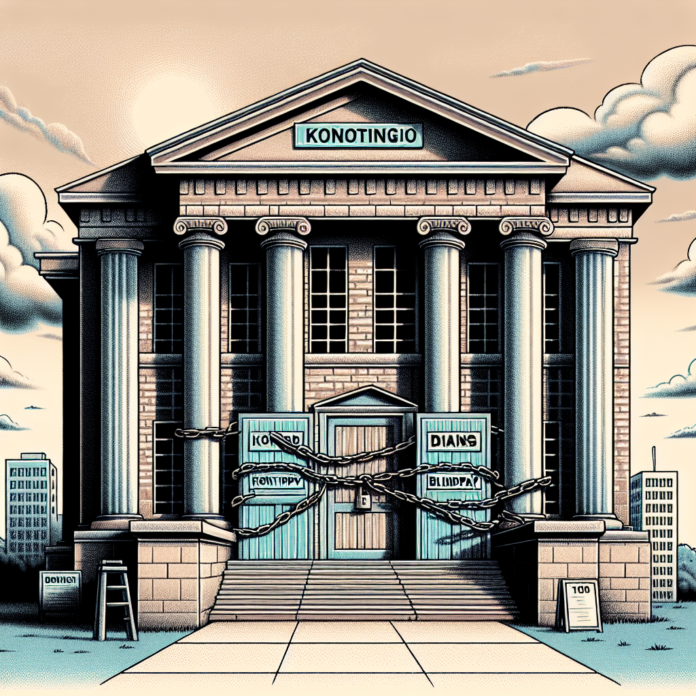

JPMorgan Suspends Accounts of High-Risk Stablecoin Startups Kontigo and Blindpay

Bitcoin.com News

JPMorgan Freezes Accounts of ‘High Risk’ Stablecoin Startups Kontigo and Blindpay

In a significant move signaling the bank’s cautious approach to cryptocurrency, JPMorgan Chase has frozen accounts associated with two stablecoin startups, Kontigo and Blindpay. This decision highlights the growing scrutiny that financial institutions are placing on the rapidly evolving cryptocurrency landscape, particularly regarding firms perceived as high-risk.

Background on the Startups

Kontigo and Blindpay represent a wave of innovative companies aiming to provide stablecoin solutions—digital currencies designed to maintain a stable value against traditional currencies. However, the volatile nature of cryptocurrencies has raised concerns among regulators and banking institutions. Stablecoins, while intended to minimize price fluctuations, have been scrutinized for their potential to facilitate financial crimes and create systemic risks.

JPMorgan’s Stance

JPMorgan, a leading global financial institution, has been proactive in managing its exposure to the cryptocurrency market. The bank’s decision to freeze accounts tied to Kontigo and Blindpay is part of a broader strategy to mitigate risks associated with digital currencies. This action reflects the institution’s commitment to adhering to regulatory standards and ensuring compliance with anti-money laundering (AML) policies.

Implications for the Crypto Sector

The freezing of accounts for these startups serves as a warning to other cryptocurrency firms operating in a similar space. It underscores the importance of transparency and regulatory compliance for companies seeking to engage with traditional banking systems. As more financial institutions adopt stringent measures, startups may find it increasingly challenging to establish banking relationships.

The Future of Stablecoins

Despite the setbacks faced by Kontigo and Blindpay, the demand for stablecoins continues to grow. These digital assets play a crucial role in facilitating transactions, providing liquidity, and offering a bridge between the crypto market and traditional finance. As the regulatory landscape evolves, it will be vital for stablecoin issuers to align with the expectations of financial institutions to ensure their long-term viability.

Conclusion

JPMorgan’s decision to freeze accounts for Kontigo and Blindpay highlights the cautious approach that traditional banks are taking toward cryptocurrency ventures. As the landscape continues to change, both startups and established firms will need to navigate the complexities of regulation while fostering innovation within the stablecoin sector. The balance between growth and compliance will be crucial in shaping the future of digital currencies.