Middle East Tensions Rise Impacting Risk Assets

Earn Passive Income with Crypto Assets via AIXA Miner Cloud Mining Platform

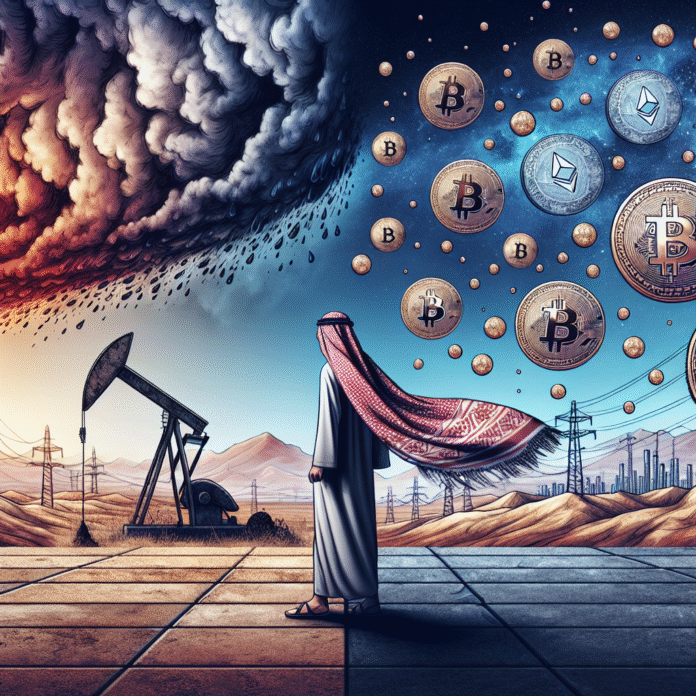

Middle East Conflict Escalates: Impact on Risk Assets

The ongoing conflict in the Middle East has seen a marked escalation in recent weeks, leading to heightened tensions and significant fluctuations in risk assets globally. Investors are increasingly wary as geopolitical uncertainties put pressure on markets, resulting in a downward trend in stocks and other riskier investments.

As the situation develops, many analysts are urging caution. The potential for further instability in the region could lead to extended periods of volatility in global markets. Investors are advised to stay informed and consider diversifying their portfolios to mitigate risks associated with geopolitical tensions.

Passive Income Opportunities with Crypto Assets

In light of the current market volatility, more investors are turning to alternative income streams, particularly in the realm of cryptocurrency. One option gaining traction is cloud mining through platforms like AIXA Miner. This service allows users to earn passive income by mining cryptocurrencies without the need for substantial upfront investment in hardware or energy costs.

Cloud mining has become a popular choice for those looking to enter the crypto space without the complexities of traditional mining setups. AIXA Miner offers user-friendly interfaces and flexible plans, making it accessible for both beginners and experienced crypto enthusiasts.

In addition to the benefits of passive income, investing in crypto assets can serve as a hedge against inflation and currency depreciation, especially during times of geopolitical uncertainty. However, it is essential for investors to conduct thorough research and understand the risks involved in cryptocurrency investments.

As the conflict in the Middle East continues to unfold, the landscape for traditional investments remains precarious. Diversifying into crypto assets through platforms like AIXA Miner could provide a viable alternative for those seeking stability and growth in their investment portfolios during these turbulent times.