Bitcoin’s On-Chain Activity Slump Leads Analyst To Claim Apex Crypto’s Shift From P2P Cash To Store Of Value

Benzinga

Bitcoin’s On-Chain Activity Slump Leads Analysts to Claim Apex Crypto’s Shift from P2P Cash to Store of Value

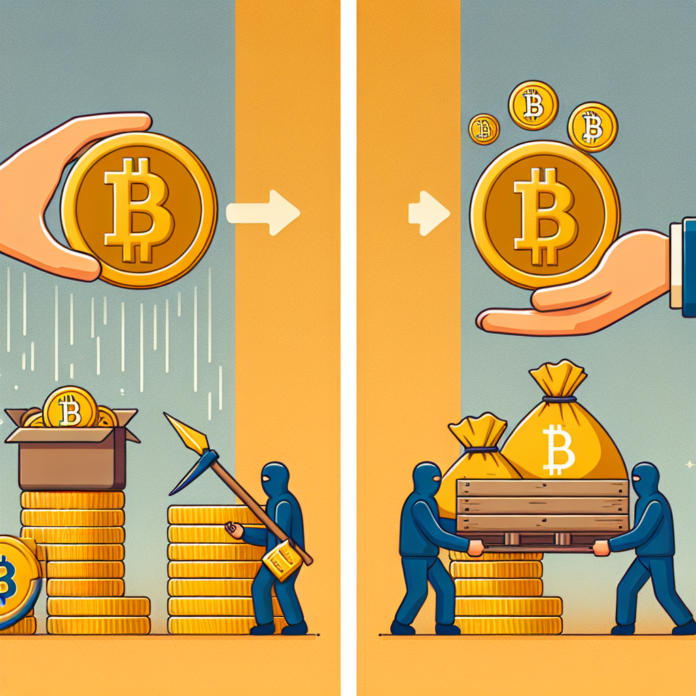

Bitcoin’s recent decline in on-chain activity has prompted analysts to suggest that the leading cryptocurrency is increasingly being viewed not just as a medium for peer-to-peer transactions, but rather as a store of value. This shift in perception reflects broader trends in the cryptocurrency market and the evolving use cases for Bitcoin.

Over the past few months, Bitcoin’s transaction volume has decreased significantly, leading to concerns about its utility as a currency for everyday transactions. Many observers have noted that the average number of daily transactions is down, and this decline is being interpreted as a sign that users are holding onto their Bitcoin rather than spending it. This phenomenon is often associated with the belief that Bitcoin is becoming a digital gold, a hedge against inflation, and a long-term investment rather than a currency for day-to-day use.

The implications of this shift are profound. If Bitcoin is increasingly seen as a store of value, it may attract a different type of investor—one that is more focused on long-term gains than on immediate spending. This could lead to increased volatility as speculative trading becomes more prevalent, with investors buying and holding Bitcoin in anticipation of future price increases.

Moreover, this transition raises questions about the future of Bitcoin’s scalability as a payment method. If fewer people are using Bitcoin for transactions, the network may need to reevaluate its approach to scalability and transaction fees. Solutions such as the Lightning Network are being explored to facilitate faster and cheaper transactions, but their adoption remains limited.

Additionally, the shift towards viewing Bitcoin as a store of value has implications for institutional adoption. Major companies and financial institutions are beginning to see Bitcoin as a legitimate asset class, leading to increased interest from institutional investors. This trend could further solidify Bitcoin’s status as a digital store of value, potentially increasing its price and market capitalization over time.

In summary, the decline in Bitcoin’s on-chain activity is prompting analysts to reassess its role within the cryptocurrency ecosystem. While the traditional view of Bitcoin as a peer-to-peer cash system may still hold merit, the growing perception of it as a store of value could reshape its future and impact the overall cryptocurrency market. As Bitcoin continues to evolve, stakeholders will need to adapt to these changing dynamics and consider the broader implications for adoption, scalability, and investment strategies.