All ITR Forms Released Yet Taxpayers Must Hold Off on Filing

Understanding the Delay in Return Submission

All ITR Forms Released, but Taxpayers Must Wait to File Returns

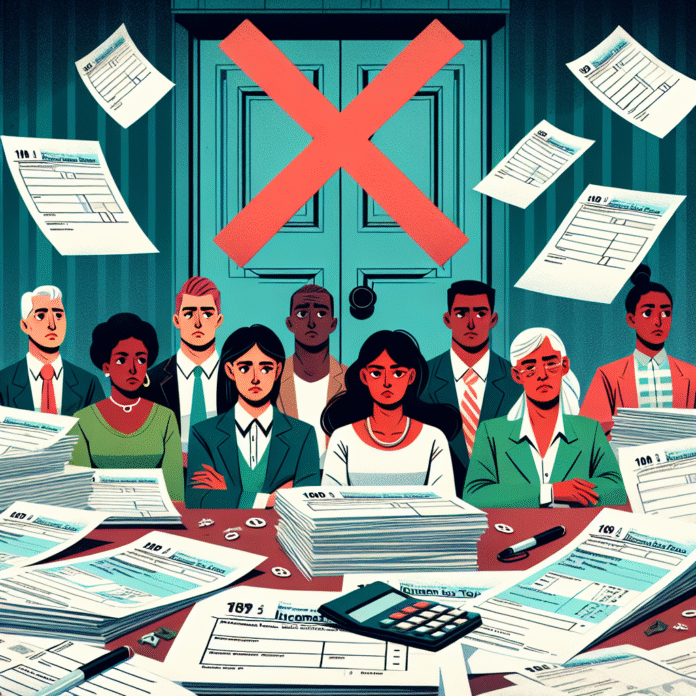

Tax season is here, and while the Income Tax Return (ITR) forms for the current financial year have been made available, taxpayers still face delays in filing their returns. This situation raises concerns for many individuals and businesses eager to complete their tax obligations. Here’s a closer look at the reasons behind this delay and what taxpayers can expect going forward.

Understanding the Delay in Filing

Despite the release of ITR forms, the actual filing process remains unavailable due to several underlying factors. One primary reason is the ongoing updates and maintenance of the Income Tax Department’s e-filing portal. These enhancements are intended to improve user experience and ensure that the system can handle the increased traffic during the tax filing season. However, the updates have caused temporary disruptions, leaving taxpayers unable to submit their returns.

Additionally, the government often introduces changes to tax regulations and compliance guidelines. These alterations may require further adjustments to the ITR forms or the e-filing system itself, leading to further delays. Taxpayers should remain informed about any new announcements or guidelines released by the Income Tax Department to stay ahead of the game.

What Taxpayers Can Do in the Meantime

While waiting for the e-filing system to become operational, taxpayers are encouraged to gather all necessary documentation and information required for filing. This includes:

– **Income Statements**: Collect all relevant income statements, including Form 16 from employers, and receipts from any freelance or business income.

– **Deductions and Exemptions**: Review eligible deductions under sections like 80C, 80D, and others to maximize tax savings.

– **Investment Details**: Keep track of all investments made during the financial year, as they may impact taxable income.

Taxpayers can also take this time to familiarize themselves with the new ITR forms and the changes made compared to previous years. This proactive approach will help streamline the filing process once the system is up and running.

Anticipated Timeline for Filing

The Income Tax Department typically sets a timeline for the filing of tax returns, and while specific dates have not yet been announced, it is crucial for taxpayers to monitor official communications for updates. Typically, the government aims to finalize the e-filing portal by the end of the month, allowing taxpayers sufficient time to complete their returns before the deadline.

Conclusion

The release of ITR forms is a significant step in the tax filing process, but taxpayers must exercise patience as they wait for the e-filing system to become operational. By staying informed and preparing necessary documentation, individuals can ensure a smooth filing experience once the portal is ready. Keeping an eye on announcements from the Income Tax Department will also provide clarity on when taxpayers can resume filing their returns.